Describe the short run trade-off between inflation and unemployment. Why is there not a long-run trade-off? How long do you think the short-run lasts? (Or do you believe there is a trade-off at all - many economists don't. Why?

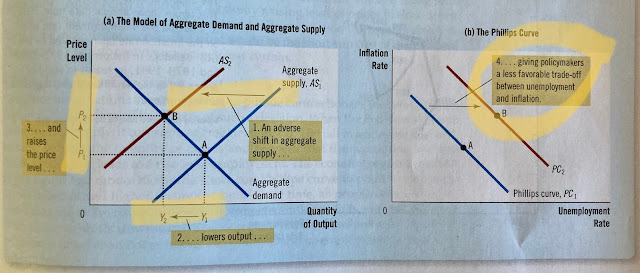

Inflation and unemployment are linked in ways that economists now understand more clearly. In short, low unemployment is associated with high aggregate demand, which in turn puts upward pressure on wages and prices throughout the economy. This relationship is described as the Phillips curve. Because monetary policies shift the aggregate demand curve, the policies can move an economy along the Phillips curve. The Phillips curve compares inflation rates with unemployment rates and a balance is created between the two factors,

The length of time a short-run lasts depends on other factors in the economy but typically would be a day to a half of a year. This period allows for firms to make corrections which will move towards inflation-unemployment ratio. The Phillips curve trade-off is not stable and we correct itself by raising prices or higher inflation.

Is it a trade-off? I would think so. A decision is being made to the direction of the economy. The Fed would be trading one for another in the short-term. I understand the idea of this merely being a temporary adjustment, and not a trade at all but because of the reality of the short-term effects, a trade is being made in the desired outcomes for the economy as a whole.